Saturday, March 12, 2011

Sunday, February 27, 2011

4. Don't wanna accept the losses

5:06 AM

5:06 AM

Denis

Denis

First you need to understand that trading is not like regular job! On a regular job you will go to work and

earn your pay, but Forex trading is more like business with unpredictable costs or TENNIS game. In

tennis game even if you are professional player you will loose some and win some. Everything depends on

how good player you are. I have said earlier that you need to play the game to win and not to risk all

you have to only one position. Maybe you are wrong! A little bit later I will talk that you need to be ready

for the market and market has to be ready for you (for your trading strategy). When you are playing the

FOREX game then try to analyze the market and only when you see 3 spots you can enter the market.

What are the 3 spots?

3 spots are:

1. Good signal for entry the market.

2. Exit point ( where to put stop loose).

3. Take profit point!

Lots of you are trading with impatience and uncertainty and when you see only one of these spots you are

jumping into the market. I think that you understand now why it is so important to be patient. I know that

lots of you will say: " If I don't trade today then I won't earn my pay!". You must understand that

sometimes market isn't ready for your strategy for a few days or maybe even a week.

So, if you don't trade today you won't make money and that is correct but you won't loose the money

either. And that is the point. Ok, I will make an explanation why it is so hard to accept the loss. In the

world where we live there are certain rules and we learn to live by those rules from our birth.

When a child does something good it would be rewarded but when child make a mistake it will be

punished. Remember the school, if you make an effort, you have good grades and if you don't make an

effort, you have lousy grades. After school, in life, you can also find this in low regulation. If you make a

mistake then you will bi punished and that is the style of life which forces people to be perfect and that they

mustn't make a mistake. But Forex trading or any other game is all about accepting your mistakes.

(Cut your losses short)-(Let the profit run)! Don't try to make your trading strategy 100% accurate but

accept your losses and find a way to limit them.

earn your pay, but Forex trading is more like business with unpredictable costs or TENNIS game. In

tennis game even if you are professional player you will loose some and win some. Everything depends on

how good player you are. I have said earlier that you need to play the game to win and not to risk all

you have to only one position. Maybe you are wrong! A little bit later I will talk that you need to be ready

for the market and market has to be ready for you (for your trading strategy). When you are playing the

FOREX game then try to analyze the market and only when you see 3 spots you can enter the market.

What are the 3 spots?

3 spots are:

1. Good signal for entry the market.

2. Exit point ( where to put stop loose).

3. Take profit point!

Lots of you are trading with impatience and uncertainty and when you see only one of these spots you are

jumping into the market. I think that you understand now why it is so important to be patient. I know that

lots of you will say: " If I don't trade today then I won't earn my pay!". You must understand that

sometimes market isn't ready for your strategy for a few days or maybe even a week.

So, if you don't trade today you won't make money and that is correct but you won't loose the money

either. And that is the point. Ok, I will make an explanation why it is so hard to accept the loss. In the

world where we live there are certain rules and we learn to live by those rules from our birth.

When a child does something good it would be rewarded but when child make a mistake it will be

punished. Remember the school, if you make an effort, you have good grades and if you don't make an

effort, you have lousy grades. After school, in life, you can also find this in low regulation. If you make a

mistake then you will bi punished and that is the style of life which forces people to be perfect and that they

mustn't make a mistake. But Forex trading or any other game is all about accepting your mistakes.

(Cut your losses short)-(Let the profit run)! Don't try to make your trading strategy 100% accurate but

accept your losses and find a way to limit them.

3. Don't know how to control emotions

4:56 AM

4:56 AM

Denis

Denis

I know that all of you have heard about two main emotions in trading and those are

Greed and Fear. However, there are other emotions that are immanent while we trade. Emotions like:

-Have you ever experienced on the market while watching the price action that you are not sure about entering

into position or how to move your stop loss. Maybe you should take profit but you are not quite sure.

That emotion is called indecision.

-If market suddenly makes large move and you don't know why. Maybe there was some economic news

release and you forgot to check. Something is shaking the market and you don't know what to do.

That's when you have presence of panic.

-When price starts to go against us and we don't wanna close the position but we are telling

our self: " It will come back!" We just don't wanna admit our failure and we can call that

ignorance or pride (to proud to admit that I was wrong).

*But we all know that you shouldn't marry your position, just date your position and move on. (Date them!)

You must learn to control your emotions and don't let them control you, because they are bad emotions.

When you trade, you must be relaxed and your mind has to be calm. I must say that you won't feel these

emotions while trading on a FOREX demo account but when you start trading on a real account, those

emotions will come to the surface. You can feel those emotions if you are watching the screen while

trading. Some traders like to setup their positions on autopilot with pending orders so they don't have to look

at the P/L ratio all the time. That is only one trick how to avoid those emotions.

Greed and Fear. However, there are other emotions that are immanent while we trade. Emotions like:

-Have you ever experienced on the market while watching the price action that you are not sure about entering

into position or how to move your stop loss. Maybe you should take profit but you are not quite sure.

That emotion is called indecision.

-If market suddenly makes large move and you don't know why. Maybe there was some economic news

release and you forgot to check. Something is shaking the market and you don't know what to do.

That's when you have presence of panic.

-When price starts to go against us and we don't wanna close the position but we are telling

our self: " It will come back!" We just don't wanna admit our failure and we can call that

ignorance or pride (to proud to admit that I was wrong).

*But we all know that you shouldn't marry your position, just date your position and move on. (Date them!)

You must learn to control your emotions and don't let them control you, because they are bad emotions.

When you trade, you must be relaxed and your mind has to be calm. I must say that you won't feel these

emotions while trading on a FOREX demo account but when you start trading on a real account, those

emotions will come to the surface. You can feel those emotions if you are watching the screen while

trading. Some traders like to setup their positions on autopilot with pending orders so they don't have to look

at the P/L ratio all the time. That is only one trick how to avoid those emotions.

2.Insufficient discipline to follow the trading plan

4:48 AM

4:48 AM

Denis

Denis

Second problem why traders lose money is insufficient discipline to follow the trading plan.

Why wouldn't trader follow the plan? There can be few reasons.

Maybe he isn't comfortable with his trading plan.

If you wish to trade 5 different trades on intraday basis, then you don't need long term investment

strategy. Also, if you are trying to trade small account size with strategy for large account size then

you would not feel comfortable.

Maybe you are trading at a wrong time.

First define your needs and then find trading strategy that will suit your needs.

Another problem why trader would have insufficient discipline to follow the trading plan is that

trader doesn't know how to control the emotions.

Why wouldn't trader follow the plan? There can be few reasons.

Maybe he isn't comfortable with his trading plan.

If you wish to trade 5 different trades on intraday basis, then you don't need long term investment

strategy. Also, if you are trying to trade small account size with strategy for large account size then

you would not feel comfortable.

Maybe you are trading at a wrong time.

First define your needs and then find trading strategy that will suit your needs.

Another problem why trader would have insufficient discipline to follow the trading plan is that

trader doesn't know how to control the emotions.

1. Insufficient trading plan

4:44 AM

4:44 AM

Denis

Denis

I have been talking with lots of new traders and when I ask them to tell me their trading strategy

I get different answers.

For example:

1. My trading strategy is a secret!

2. I use stochastic and moving averages!

3. My trading strategy for tomorow is: if 1.3000 would be broken then price will go up.

4. What is trading strategy, etc.

So I will answer what trading strategy is and what it isn't. Trading strategy is not a secret! Trading strategy is

just a tool for trading. There are lots of trading strategies and you need to find one that suits you.

Trading strategy will tell you 3 things: 1. Where to enter the market, 2. Where to put your Stop loss,

3.Where to take profit!

For example: you will risk 25 pips (1%), and your target would be 25 pips (1%).

If you make a gain it will be 1% of profit or if you make a loss then your equity would be -1% !

Trading plan is something else!

You need trading plan to tell you what currency pair to trade, exact time for trading and to setup your goals.

What is your daily goal and max daily risk!

What is your weekly trading goal and what is your weekly trading risk.

For example:

Monthly risk: -5% Monthly goal: 14%

Weekly risk: -3% Weekly goal: 3,5%

Daily risk: -2% Daily goal: 1%

You need to create your trading plan and to have it on your desk.

First thing that you need to do when you are sitting in front of your computer is to check your trading plan

to see what is your goal for today. When you are finished with your trading day, also check your trading

plan to compare your trading results with your goals. It is very important to follow your trading plan!

I get different answers.

For example:

1. My trading strategy is a secret!

2. I use stochastic and moving averages!

3. My trading strategy for tomorow is: if 1.3000 would be broken then price will go up.

4. What is trading strategy, etc.

So I will answer what trading strategy is and what it isn't. Trading strategy is not a secret! Trading strategy is

just a tool for trading. There are lots of trading strategies and you need to find one that suits you.

Trading strategy will tell you 3 things: 1. Where to enter the market, 2. Where to put your Stop loss,

3.Where to take profit!

For example: you will risk 25 pips (1%), and your target would be 25 pips (1%).

If you make a gain it will be 1% of profit or if you make a loss then your equity would be -1% !

Trading plan is something else!

You need trading plan to tell you what currency pair to trade, exact time for trading and to setup your goals.

What is your daily goal and max daily risk!

What is your weekly trading goal and what is your weekly trading risk.

For example:

Monthly risk: -5% Monthly goal: 14%

Weekly risk: -3% Weekly goal: 3,5%

Daily risk: -2% Daily goal: 1%

You need to create your trading plan and to have it on your desk.

First thing that you need to do when you are sitting in front of your computer is to check your trading plan

to see what is your goal for today. When you are finished with your trading day, also check your trading

plan to compare your trading results with your goals. It is very important to follow your trading plan!

Why traders lose money

4:39 AM

4:39 AM

Denis

Denis

6 common oversights

I will try to explain why traders lose money. There are 6 common oversights that trader can make,

so I will try to explain every failure with details.

Here are six common oversights that trader can make:

1. Insufficient trading plan

2. Insufficient discipline to follow the trading plan

3. Don't know how to control emotions

4. Don't wanna accept the losses

5. Insufficient commitment

6. Over-trading

I will try to explain why traders lose money. There are 6 common oversights that trader can make,

so I will try to explain every failure with details.

Here are six common oversights that trader can make:

1. Insufficient trading plan

2. Insufficient discipline to follow the trading plan

3. Don't know how to control emotions

4. Don't wanna accept the losses

5. Insufficient commitment

6. Over-trading

Saturday, February 26, 2011

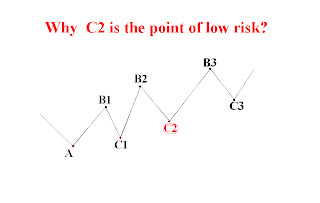

TRADING strategy C2

7:26 AM

7:26 AM

Denis

Denis

First, I will show you why C2 is considered as the point of the minimum risk when you wish to trade the trend and second I will show you how to correctly apply trading strategy with correct money management.